Your cart is currently empty!

Blog

Why Is My Business Insurance So Expensive?

In this post, we cover the different factors that might contribute to high business insurance costs, such as industry risk, claims history, coverage amount, location, etc.

Wholesale Relationships

This is something often transparent to an insured, but just remember there is always someone in the background trying to help your company. This blog is to let you know why strong wholesale broker relationships are important to an agency.

Navigating Your Policy: Avoid Getting Blinded by Your Declarations Pages

In the world of commercial insurance, policyholders often find themselves navigating through complex documents filled with industry jargon and technical terms. The majority of startups don’t read their insurance policies.

Spring Cleaning Your Commercial Insurance Program: A Busy Executive’s Guide

As spring arrives, it’s not just our homes that could benefit from a thorough cleaning – it’s also an

opportune time for business owners to tidy up their commercial insurance programs.

ITC Vegas 2023

InsureTech Connect is where the insurtech community across the globe meets in Vegas each year. There is always a star-studded lineup of speakers, from insurtechs, legacy carriers, technology partners, and investors.

One Startup’s Insurance Journey: Formation to Acquisition

How many companies grow 500+ employees and get acquired for $200M+ in less than 2 years? We only know of one in recent Austin history. This startup’s journey from formation to acquisition from an insurance perspective is a great example of a desired client journey despite being extremely condensed.

Insurance Mindset Shift for Startups

Creating a tech company from scratch is a process that will often be equated to a wild ride regardless of the outcome. In the early days, the insurance mindset is drastically different than when the company matures.

Insurance Policies Your VCs Want Post Funding

The primary reason we receive inquiries about insurance is a funding event. Many founders typically don’t think too much about Directors & Officers (D&O) and Key Person Life Insurance until they get a term sheet.

What is International Insurance and Does Your Business Need it?

If you’re like me, you’re out there watching TikTok videos or working with remote teams without a care of where in the world they are. But, when it comes to your business insurance, country boundaries are very important and make a huge difference as to when something is covered and when something is not covered.

Keeping the Holiday Party Tame and Getting Everyone Home Safe

As a follow up on our prior blog, The Office ‘Non-Denominational Holiday Mixer’: Tips for keeping Everyone Safe and Out of Trouble During Company Holiday Parties, we recap the best measures the party planning committee can implement to keep everyone safe during the holiday season.

The Final Insurance Inflection Point for Startups

A common question asked regarding insurance in the startup space is ‘what do I need and when do I need it?’ The answers vary based on revenue, clients, and number of employees, but the most common ones are outlined in the Lumen blog, 5 Insurance Inflection Points for Insurance.

D&O Tail Coverage – Tips for the Acquisition

The prior Lumen blog, What Happens to Your Insurance Program If You Don’t IPO, states the most likely outcome for startups is an acquisition. As covered by Austin Inno, Silicon Hills News and the ABJ…acquisitions are taking place weekly in the ATX. So what do startups need to know about D&O coverage prior to an acquisition?

Insurance and PEOs: Playing Nice Together

In this months blog, the PEO (Professional Employer Organization) model is explained as well as why startups like the PEO model. From an insurance perspective, what implications does working with a PEO have on your commercial program? Find out how insurance agents and PEOs can complement each other to benefit your startup.

“Common Insurance Requirements in A Commercial Lease (And What You Can Negotiate)”

Funding typically triggers another insurance inflection point in the startup journey: signing a commercial lease. A common insurance request from startups is to make sure current insurance coverage will meet the landlord’s requirements in a lease. This month’s blog shares common insurance requests by landlords and a few insurance tips.

SXSW on Limited Time: The Premier SXSW Events to Attend for Busy Founders

This year my wife had a baby two weeks before SXSW, so I had to be extremely focused on where I spent my time this SXSW. Though I like grabbing beers with the masses during the Startup Crawl, very little business gets done. So that was the first event to go to for me.

Electric Scooters: Liability Concerns for Startup Owners and Their Employees

Scooters are everywhere in urban areas all across the nation, and it does not look like they are going anywhere in Austin anytime soon. This month we discuss personal and business liability involved with riding an electric scooter. Then we answer the more important question of how insurance will respond. As a bonus we also share a few key safety tips.

Back to the Grind: Pressure, Stress, Anxiety and Depression in the Tech Community

A recent Forbes article discusses why depression increases during the holidays and can be summed up in three words: stress, family and expectations.

Insurance Nerd Alert!!! – Inspiration from Mr. Incredible and Reuben Feffer

Since it is December and many of you will be watching movies over the holiday break, I thought it might be fun to comment on two of my favorite characters related to insurance in the movies. In this month’s blog, find out why I like Reuben Feffer from Along Came Polly and Bob Parr from The Incredibles.

The Office ‘Non-Denominational Holiday Mixer’

There is a reason why Saturday Night Live (SNL), The Office, and Office Christmas Party poke fun at office ‘Non-denominational Holiday Mixers.’ Feel free to watch any of these videos at your own risk to see what I mean.

Is Your Startup As Secure As You Think It Is?

For the record, National Cybersecurity Awareness Month (NCSAM) was not created in resistance to Skynet, the ‘Synthetic Intelligent Machine Network’ despite the title of this blog.

How to Choose Wisely When It Comes to Accelerators and VCs

Raising funds seems like the Holy Grail of the startup community. Spend time around an accelerator or co-working space in ATX, and you will overhear someone talking about raising money.

Key Person Life: Your VC Wants Key Person Life Insurance on You and Why It’s Not ‘Weird’

Often times, Key Person Life is a requirement from institutional investment firms as part of their investment in a company. There was a similar scenario in the movie Along Came Polly if you have seen it.

D&O: Why Underwriters Care about Your Financial Runway?

For startups, an underwriter asking for financial statements can seem invasive when searching for D&O (Directors & Officers) Insurance. So why do they ask?

Employment Practices Tips for Tech Startups

In general, this is one of the heavier topics we will cover, but I felt it was necessary given the recent headlines involving Travis Kalanick of Uber, Dave McClure of 500 Startups and Justin Caldbeck of Binary Capital.

Is Your Tech Company a Tech Company to an Underwriter?

What is a liger? Napoleon from the 2004 movie Napoleon Dynamite says, ‘It’s pretty much my favorite animal. It’s like a lion and a tiger mixed… bred for its skills in magic.’ You will have to read through the end to see how this ties into the conversation…

Too Busy ‘Crushing It’ to Run That Contract by Legal…

The single most important goal of any sales team is to generate revenue. This is often referred to in The Valley as ‘Crushing It’. So, in case you wanted to see a ‘bro-like’ exaggeration of what I’m talking about, click on the link above.

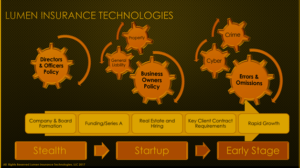

5 Insurance Inflection Points for Startups

Your goals may include raising a significant amount of money, disrupting your industry, and/or becoming the next unicorn in the industry. If that is the case, you will have a series of insurance inflection points to discuss with your insurance broker which includes D&O.

Do I Need D&O Before or After I Raise Money for My Tech Startup?

Start-up founders are generally calculated risk takers. So, why would a founder purchase D&O insurance before funding vs after? There is no right or wrong answer but two common scenarios are outlined below.