D&O Tail Coverage – Tips for the Acquisition

The prior Lumen blog, What Happens to Your Insurance Program If You Don’t IPO, states the most likely outcome for startups is an acquisition. As covered by Austin Inno, Silicon Hills News and the ABJ…acquisitions are taking place weekly in the ATX. So what do startups need to know about D&O coverage prior to an acquisition? This month’s blog highlights D&O tail coverage basics and tips on helping get coverage in place prior to the acquisition.

What is Tail Coverage for D&O?

Directors & Officers policies are claims made policies, which is why tail coverage is important to have post acquisition. This means the policy in force when a claim is made is the one that responds to a covered claim. But what happens if a company is acquired and it takes years for a lawsuit to bubble up against the Executives or the Board after the close? An Extended Reporting Period (ERP), discovery period, and/or runoff are all policy provisions designed to help in the post-acquisition time frame. These options are often referred to as ‘tail coverage.’ In general, a company is purchasing time to report claims that occurred prior to the acquisition.

Runoff – In an acquisition scenario, a D&O policy would remain in force (i.e., not be cancelled) and go into ‘runoff’ on the acquisition date until the end of the policy period. This is considered tail because it is giving the insured until the end of the policy period to report a claim that occurred prior to the acquisition date.

ERP – In an acquisition situation, the policy will most likely be cancelled on the acquisition date. If the company has the option to purchase an ERP, this period is designed to allow claims that are discovered post acquisition. Most often they are purchased in terms of years from 1-6 years as allowed by the carrier. Keep in mind some carriers call this a discovery period.

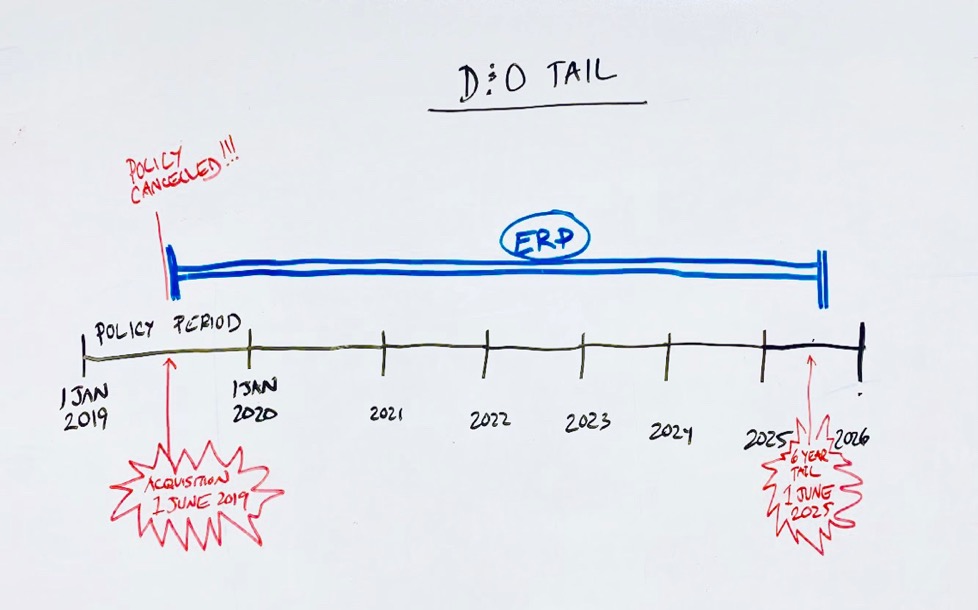

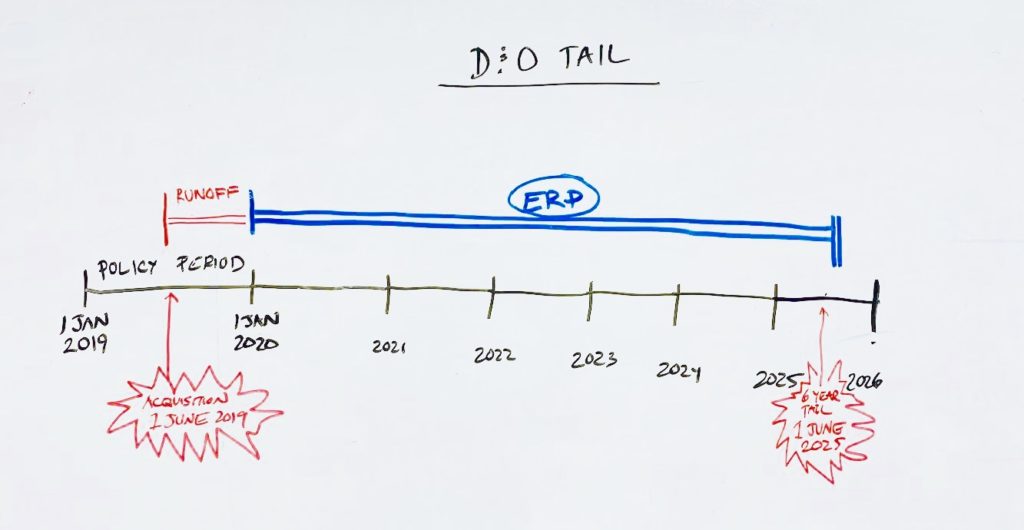

Here are two scenarios drawn on a white board.

Scenario 1:

The acquiring company required 6 years of tail coverage. Post acquisition the D&O policy is cancelled and sent into ERP for 6 years.

Scenario 2:

The acquiring company required 6 years of tail coverage. The insured could use a combination of runoff and ERP to get to the 6 year mark post acquisition.

Post acquisition the policy is kept in force going into runoff then ERP is purchased to get to the year post acquisition date.

Why Does Your Acquiring Company Require This?

In most substantial acquisitions, tail coverage is required as part of the acquisition. Typically, the company being acquired would have more of a vested interest in making sure the appropriate tail coverage is purchased after the acquisition and would pay. Since the execs of the company being acquired can be personally named on a lawsuit, they would certainly want to make sure a D&O ERP is purchased if not required by the deal. The acquiring company does not want to get dragged into a lawsuit for something that happened prior to the acquisition, so this is one more reason they ask for the coverage.

This can be paid for as part of the provisions in the sale by reducing the amount of stock purchased, or can simply be on your own dime. Either way, it is all negotiable and should be part of the conversation before the deal is done.

Will Your Carrier Offer ERP?

Not all carriers are created equal. Some carriers have clearly defined options (terms and pricing) for tail coverage, and some only offer a free… ‘mini-tail’ [pinky finger in the corner of my mouth] of 30, 60 or 90 days. The caution here is to be aware that not all carriers and policies will offer tail coverage. There are situations, such as a hostile takeover, where the carrier will want to steer clear. To protect themselves from a certain loss, they may not offer an ERP. This does not mean you will be left high and dry because there is a secondary market for this. It will just cost you…

Pro Tips on D&O Tail

Most acquisitions are held close to the vest. It might be because of a high profile acquirer, or it may be because there was focus elsewhere in the term sheet. Either way it is highly recommended to get your agent involved as soon as possible. Agents can help you understand how much tail coverage will cost, how tail coverage will work and if there are any situations that could hold up the closing.

I have been in a few situations where a client notified Lumen that a deal was closing in a few days. In short, there were lots of questions from the underwriters, and this was the last item to cross off the list before close. The coverage was eventually put in place, but it did push back the close and had lots of undue stress on the CEO, the lawyers, VC and the agent. Bottom line is you need to keep your agent in the loop so they can posture, coach and react appropriately to the situation.

Other solid ideas:

- Make sure your lawyer is involved.

- Keep the board and major investors in the loop.

I Still Don’t Know What D&O Is and Why I Might Need It….

About Lumen:

Lumen Insurance Technologies is a tech-focused commercial insurance agency based in Austin, Texas. Lumen is hyper-focused on providing the technology startup ecosystem with quality commercial insurance coverage (e.g. D&O, E&O, Cyber, etc.) following a funding event and beyond.

Check us out on the web at www.lumeninsure.com to find more blog topics, general info, or to get help with finding coverage. Email us at info@lumeninsure.com if you would like to suggest a topic for future blogs.

Connect with us and stay up to date with news from our client base by following us on Instagram, LinkedIn, and Twitter.