5 Insurance Inflection Points to Discuss with Your Insurance Broker

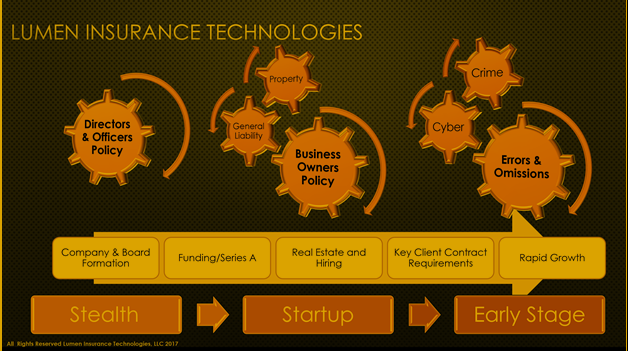

Your goals may include raising a significant amount of money, disrupting your industry, and/or becoming the next unicorn in the industry. If that is the case, you will have a series of insurance inflection points to discuss with your insurance broker which includes D&O.

Board Formation

Forming a company and getting the right team in place is critical. Funding teams look for key board members. They might help the company get to a place where they can raise significant funds or at a least open the door to VCs all over the nation. The bigger the name, the more likely they will want ‘personal protection.’ For first time founders this is code for Directors & Officers (D&O) Insurance. See another Lumen blog titled: ‘ Do I Need D&O Before or After I Raise Money for My Tech Startup?.’

Policy typically associated with bringing on a key board member: D&O

Significant Funding

If you are raising funds from institutional investors or VCs, chances are you are going to have your lead investor on your board. This is why D&O is often required by your lead investor. Often times VCs will also need key man life on a couple of the founders, especially the technical co-founder. If for some reason one of these key employees passes away, the key man life policy would help find a replacement for that individual.

Policies typically associated with significant funding: D&O and Key Man life

Commercial lease

Going from the proverbial garage to a commercial lease may trigger several lines of coverage concerns. A sophisticated landlord may have some pretty stout requirements.

Policies typically associated with a commercial lease: Business Owners Policy, General Liability, Workers Compensation, and a Commercial Umbrella

Growing the Team

At this point, the team will be growing very quickly. Bringing on employees can often lead to some increased exposures on the HR side of things. This may include employment practices related claims such as discrimination or sexual harassment. If you use a PEO, it may include Employment Practices Liability Insurance (EPLI). Be sure to review your self-insured retention!

Policies typically associated with growing the A-team: EPLI, ERISA bonds

Large Client Contracts

Massive growth is also linked to large client contracts, so the larger the company is, the larger the legal & risk management teams tend to be. This means your contracts might have specific requirements.

Policies typically associated with large client contracts: E&O, Cyber, Commercial Crime, etc.

Summary

In short, these are some of the insurance inflection points you may want to discuss with your insurance broker:

- Board formation

- Significant funding

- Commercial lease

- Growing the A-team

- Large client contracts

- World domination!

—